“Convenience is the key feature of instant money transfers. So, no delays, no queues, and no additional fees. It is an innovative solution as there are no instant international transfers currently available directly into bank accounts.”

Can you provide an overview of this new channel/product that was recently launched?

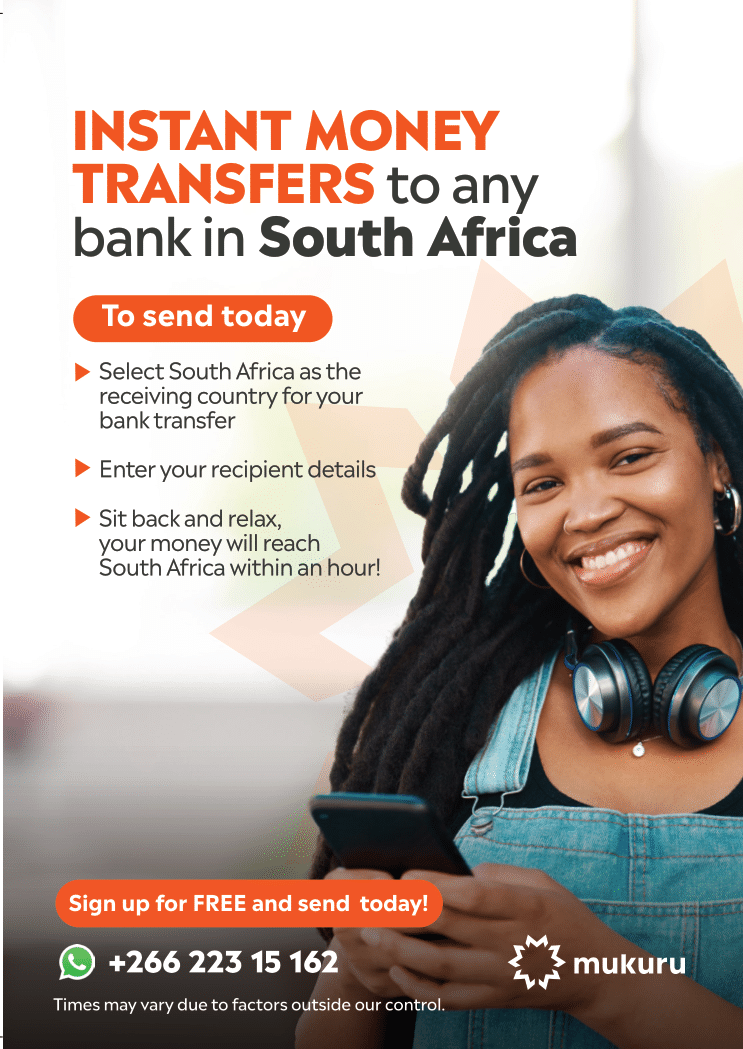

We have enhanced our current product suite to enable customers to instantly transfer funds to any major bank account in South Africa. Instant bank top-ups mean customers can receive funds from Lesotho almost as soon as the payment has been made.

What was the main objective behind launching this product?

As a customer-centric business, it is important for us to be aware of the needs of our customers and grow our financial suite of products to meet these needs. With this service, we wanted our customers to be able to access much-needed funds as soon as possible, without unnecessary delays and provide the convenience of receiving money directly into a bank account, removing the hassle of getting to a location to collect cash.

What sets this product apart from other similar offerings in the market?

The fact that the money lands in any major account within an hour of transfer is significant. Often customers would wait days for funds to reflect. Now, we have ensured real-time delivery for our customers.

Please elaborate on the key features of this product and how it addresses specific challenges in the financial industry?

Convenience is the key feature of instant money transfers. So, no delays, no queues, and no additional fees. It is an innovative solution as there are no instant international transfers currently available directly into bank accounts

In what ways do you believe this product will revolutionize the fintech industry or make a significant impact on users’ financial experiences?

I believe accessibility to funds makes a significant impact on our customers’ lives. By making the product more accessible to a broader range of users, including those in underserved or remote areas who may not have easy access to financial services, we are bridging the financial inclusion gap. There is an element of greater financial empowerment, enabling users to have the freedom to make big or small financial transfers across borders more effectively.

Kindly share some insights into the user experience design process: How did Mukuru ensure the product is user-friendly and accessible to a wide range of users?

Mukuru is a customer-centric business. We have created many feedback loops and touch points with our customers. This means we’re always listening to what is important to them, and this enables us to build products that solve real-life challenges for our customers wherever they are in their financial journey. The instant money transfers product is available on easy to access platforms such as WhatsApp. There is also a single entry for beneficiary bank details to make it user-friendly for repeat transfers.

Is there anything else you would like to share about the new product or any message you would like to convey to your current and potential users?

Mukuru makes it easier to keep loved ones connected in the most efficient ways in a world that demands speediness. Sending money directly to any bank account in South Africa to be received within just one hour, is one of many innovations we are extremely proud of. We hope you’ll give us a try today and decide for yourself.